As per reports, Vijay Ratnakar Gutte, director of the film, The Accidental Prime Minister, has been arrested by the Directorate General of Goods and Services Tax Intelligence (DGGSTI) in Mumbai for alleged Goods and Services Tax (GST) fraud of at least Rs 34 crore.

Vijay Gutte’s firm, VRG Digital Corp Pvt Ltd, has been accused of taking “fake invoices” involving GST of Rs 34 crore for animation and manpower services received from Horizon Outsource Solutions Pvt Ltd, a company that has come under the scanner of the government agency for GST fraud of over Rs 170 crore.

Reports further mention that VRG Digital Corp has also wrongly claimed a cash refund of Rs 28 crore from the government against CENVAT (Central Value Added Tax) credit received for these fake invoices since July 2017.

Vijay Gutte has been booked under Section 132 (1)(c) of the CGST Act, which pertains to “wrongful availment” of input tax credit using bills and invoices that have been issued without any supply of goods or services. Under the rules, in cases where the amount of tax evaded or the amount of input tax credit wrongly availed or utilised, or the amount of refund wrongly taken exceeds Rs 5 crore, the accused is liable to be fined and imprisoned for up to five years.

“The accused (Gutte) had not only availed of non-existent input tax credit (ITC) but further went ahead and fraudulently claimed refund of such ITC from the GST department on the strength of such fake/ bogus invoices to defraud state exchequer,” said the remand application filed in the court. The agency also said that Vijay Gutte was not cooperating with the investigation.

The DGGSTI has found that Horizon Outsource had wrongly taken GST credit of Rs 80 crore from the government by showing fake invoices of software services received from Best Computer Solutions. The probe has also found that Horizon Outsource also issued bogus invoices showing GST of Rs 47 crore to its clients.

The agency’s probe has revealed that Gutte’s VRG Digital Corp was one of the top clients of Horizon Outsource Solutions and was shown as receiving services of about Rs 266 crore with a GST implication of Rs 40 crore, even as there was no actual supply of services, according to the remand application filed in court.

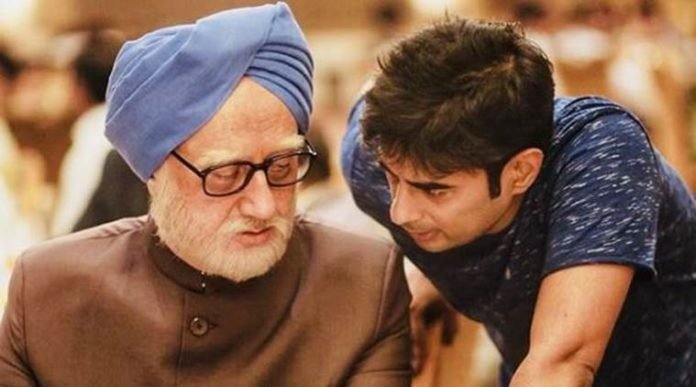

Image source: here

![Zee Music moves Delhi High Court to challenge the interim statutory license granted by Copyright Office to Kuku & Koyal Internet Pvt. Ltd [Read Order]](https://iprmentlaw.com/wp-content/uploads/2018/02/zee-music-100x70.jpg)