Shankey Agrawal is an advocate with over 9 years of experience in the field of Indirect Tax advisory and Litigation (before administrative and judicial fora). He has been associated with Deloitte as a retainer counsel since September 2017, providing Litigation Support including representational services as an advocate in Indirect Taxation.

Prior to joining as Senior Adviser and retainer counsel to Deloitte LLP, Shankey has worked with BMR Legal as Managing Associate and Economic Laws Practices, New Delhi as Assistant Manager. Shankey was also a Senior Associate with M/s Lakshmi Kumaran and Sridharan Advocates, one of India’s largest Indirect Tax Firms. He is an expert in the area of indirect-taxation and has authored various articles. He has been actively involved for over eight years in advising Indian and foreign companies in Service-tax, Excise, Value Added Taxes as well as cross border customs issues. He has also handled complex and high profile indirect tax matters at High Court and Supreme Court level.

Shankey has a Bachelor of Law degree from ILS Law College, Pune University. He has also completed the Company Secretary Course from Institute of Company Secretaries of India and is also qualified as Advocate-on-Record, Supreme Court of India.

Implications of GST on Entertainment and Media Industry – Part-I

Shankey Agrawal

By an estimate, media and entertainment sector alone is responsible for generating revenue of about INR 3-4 Trillion per annum. This revenue in turn translates into a hefty tax collection in the form of various direct as well as indirect taxes to both Central and State Governments. Not only revenue, this sector remains one of the key contributors for economy by generating large scale employment and tourism in the Country. Having said that, this sector remains one of the most neglected sector as far as government’s economic and financial policy is concerned. Union Budgets over the years are testimony of long neglect by the government towards this sector. Sadly enough, instead of getting the support from Government in the form of tax sops and ease of taxation, the industry has suffered over the years due to multiple taxes and lack of clarity in the tax provisions.

Problems with the existing tax regime

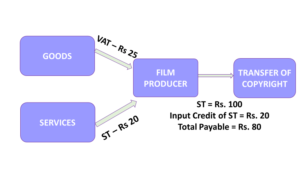

Prior to introduction of GST, Indian taxation system was one of the most complex in the world with multiple taxes on the same activity. The position of Media & Entertainment Sector was not very different and it also faced several tax levies. The main problem prior to GST was credit blockage of various taxes. This can be better understood by was of the following example:

A film producer at the time of production of film consumes various goods and services. These goods and services were liable to various taxes for e.g. Service Tax, VAT, Local Body Tax etc. In theory, Credit of input taxes must be available during payment of taxes on output supplies. However, the film producer would only have output tax liability of only one tax i.e. Service Tax. In such a scenario, Input tax credit of all other taxes would get blocked and it became a cost.

**Note – Credit of VAT is not available, resulting is loss of Rs. 25. Total tax cost becomes Rs. 105 i.e. Rs. 80 (ST) + Rs. 25 VAT

In this backdrop, GST (Goods & Service Tax) was rolled out by the Government last year with a lot of promise and fanfare. At the time of rolling out GST, the Government had promised that with GST there will be no multiple taxes on any sale or service and full credit of any taxes paid on the input goods and services. In this post, I will analyze the various indirect taxes levied on Entertainment and Media Industry prior to introduction of GST and the impact on the Industry after imposition of GST.

Taxes on the Industry prior to GST

Prior to introduction of GST, following taxes were applicable on various activities of Media and Entertainment Industry:

- Transfer of copyright for exhibition of movies in Theatre & Television:

Before GST, temporary transfer of copyright relating to films for exhibition was chargeable to Service tax. On the other hand, permanent transfer of copyrights was treated as goods and attracted state VAT. Due to blurry distinction between the two activities, there was a controversy as to whether the transaction was that of a sale of goods or provision of service and hence, there was an issue of dual levy of Service tax and VAT on transfer of copyright for exhibition on television.

Also, grant of licenses for theatrical release of films was exempt from service tax. Due to this exemption, producers were not able to offset the tax paid on input side i.e. production, actors etc. against the output tax liability and there was huge loss of tax credits.

- Cinema halls

Ticket sales by theatres were liable for Service tax by the Central Government at the rate of 15%. Further, same ticket was also liable for Entertainment tax levied by the State Government, which was over and above service tax. Entertainment tax was at the discretion of the government in the state where such cinema hall or theatre is located and varied as high as 45%.

- Sponsorship/Brand Promotion

Sponsorship services, subject to certain exceptions also attracted service tax, however the tax was charged on reverse charge basis i.e. levied on service recipient instead of service providers. Brand Promotion activity was also liable to service tax.

- Broadcast services & DTH

Broadcasting services were liable to service tax liability. On the other hand, DTH operators in addition to service tax, were also liable to pay Entertainment tax, which could be as high as 30% in some states, which was over and above their service tax liability.

- Artists, Technicians and Directors

Services of film artistes were liable to Service Tax at the rate of 15% (including cesses) of value of services.

In addition to the above, every purchase or sale of goods was also liable for VAT.

Position after GST –

In a welcome move, GST has replaced most of the Indirect taxes (i.e. Service tax, VAT, Entertainment tax, Cesses etc.) applicable on the Industry with a consolidated levy of GST. After the introduction of GST, all such transactions are liable to levy of GST. The following table provides a snapshot of applicable rate of GST on various activities of media and entertainment industry:

| Activity | Rate of tax |

| Transfer of copyright for exhibition in Theatre and Television | 12% |

| Broadcast services & DTH | 18% |

| Cinema and Entertainment event tickets | 28% + Local Body Tax (as applicable) |

| Artists, Technicians and Directors | 18% |

| Sponsorship/brand promotion | 18% |

Impact of GST on the Industry:

GST has been a welcome relief to the Industry with abolition of multiple taxes and confusion regarding applicability of taxes. There is also a seamless flow of Input tax credit which has reduced the overall tax cost. However, certain provisions under GST remain a cause for concern to the industry, which are highlighted below:

Empowerment of municipalities/local bodies to charge Entertainment Tax

- GST was touted to be a tax which will abolish all other indirect tax levies including entertainment tax. Sure enough, GST has led to removal of entertainment tax on movie tickets. However, it is unfortunate to note that the Parliament and state governments have now empowered the municipalities/local bodies to impose tax on entertainment and amusement events. Some states (e.g. Tamil nadu) have now started imposing Local Body Entertainment Tax (LBET) on the same ticket price. In effect, movie tickets are still liable for dual levy i.e. GST and LBET in some states. With more states contemplating to impose LBET on movie tickets, the problem of dual levy and excessive taxation will persist as far as movie tickets are concerned.

Compliance Burden

- GST has led to substantial increase in the compliance burden for the industry. Since GST is a state wise levy, a company is now required to register in multiple states and file monthly tax returns under GST. These requirements may be tedious for many small players.

Loss of Credit

- Rate of tax on certain input services is higher than output services for e.g. transfer of copyrights. This in turn leads to loss of Input credit of taxes paid at the lower stage. Also, where the film has not performed well at box office and is not able to recover cost, there is a substantial loss of credit as the output tax is less due to lower sales.

- GST provisions also do not allow Input Tax credit on various items including food and beverages and motor vehicles.

Tax on transfer of theatrical rights

- Grant of theatrical rights, which was earlier exempt from tax has now become taxable. Although, this leads to utilisation as well as smooth flow of Credit, however this leads to higher working capital requirement and excess tax payments

Apart from the above, there are a number of persisting issues relating to availment of Credit and place of supply, which leads to unnecessary litigation between the assessee and the department.

Conclusion

Despite the above issues, media and entertainment industry has more positive takeaways from GST than negatives. While GST has led to increased compliance burden, however overall tax cost has decreased due to availability of Input tax credit on various goods and services. The industry must now lobby hard with the government to get their fair share and iron out the difficulties faced by them under GST. In the next part of this blog, I will deal with certain specific issues in relation to media transactions faced by the Industry under GST and whether such issues can be resolved/avoided.

Shankey could be reached at shankey.agrawal@gmail.com

<<Views expressed are personal>>